Time:2024-05-20 Views:869

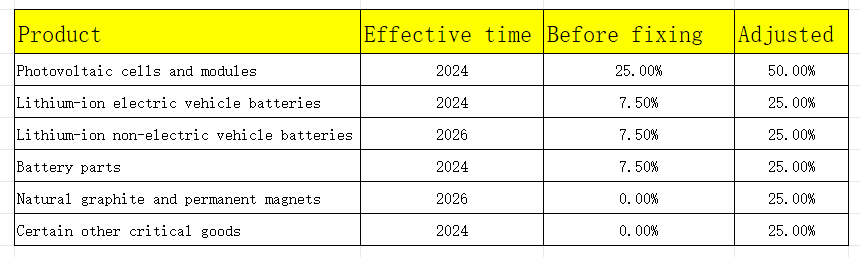

On May 14, 2024, the US government announced the results of the 301 tariff review on Chinese imports, which involved important adjustments in the two major areas of photovoltaics and energy storage. For photovoltaic products, especially photovoltaic cells and modules, the US government decided to significantly increase the tax rate from the original 25% to 50% starting in 2024. In the field of energy storage, the United States has also taken tough measures to increase the tax rate on lithium-ion electric vehicle batteries, non-electric vehicle batteries and their components. It is particularly noteworthy that the tax rate on non-electric vehicle batteries is expected to increase significantly from 7.5% to 25%, and will be officially implemented in 2026. Compared with electric vehicle batteries, energy storage batteries have been exempted from the tax rate for two years. In addition, the tax rate on natural graphite will also be increased from 0% to 25%, and this adjustment will also take effect in 2026. The following is detailed tax rate adjustment information for products related to photovoltaic and energy storage batteries:

First, let's focus on the analysis of the photovoltaic field. Before the 301 tariff increase, the United States had set up multiple trade barriers for photovoltaic cells and modules imported from China. These barriers include not only the original 25% tariff of 301, but also the anti-dumping and countervailing duties imposed on China since 2012, and the 201 tariffs imposed uniformly on all importing countries. Due to the superposition of these high tariffs, few photovoltaic companies have chosen to export products directly from China to the United States in recent years. On the contrary, in order to avoid high tariffs, they have transferred their production capacity to Southeast Asia and supplied to the US market in this way.

Compared with photovoltaic cells and modules in Southeast Asia, domestic products in the United States face pressure due to high production costs such as electricity prices and labor. Despite the subsidy support of the IRA Act, domestic photovoltaic products in the United States still find it difficult to gain a cost advantage. Therefore, in recent years, the supply of photovoltaic cells and modules in the United States has mainly relied on Southeast Asian countries. The current market focus is whether the petition for anti-dumping and countervailing investigations against the four Southeast Asian countries will have a significant impact on the demand for modules and cost structure in the United States. However, YYW expects that the impact of this 301 tax rate increase on the global photovoltaic cost structure and component demand will be relatively limited.

Next, we turn to the analysis of the energy storage field. After this tax rate adjustment, it is expected that the cost of battery cells manufactured in the United States will reach equilibrium with the cost of battery cells made in China exported to the United States in 2027. Subsequently, between 2028 and 2029, battery cells manufactured in the United States will gradually show cost advantages. However, by 2030, due to the decline of IRA subsidies, costs may tend to balance again. Combined with the promotion of the IRA Act, Korean manufacturers represented by LG and SDI are expected to benefit from a series of localization policies in the United States, thereby increasing their market share in the United States. At present, LG's expansion is particularly significant. It is expected that by 2027, LG will have an energy storage battery production capacity of about 25GWh in the United States.

Regarding the outlook for the energy storage market, given that energy storage batteries enjoy a two-year exemption period, this move has not had a direct impact on U.S. energy storage demand in the short term. However, as the exemption period approaches, market participants may adopt strategies to stock up and rush to install in advance to cope with possible price fluctuations or supply shortages in the future. Therefore, we predict that in the second half of 2025, energy storage demand will show a growth trend that exceeds original expectations.